Ashish Shroti, J

1. Petitioner has filed this writ petition under Article 226 of the Constitution of India challenging the charge-sheet dated 12/12/2024 (Annexure P/1) and the charge-sheet dated 27/3/2019 (Annexure P/6) issued by respondent no. 2, being illegal and arbitrary. He has prayed for a direction to the respondents not to institute any disciplinary proceedings in relation to the allegations made in the aforesaid charge-sheet.

2. Facts necessary for decision of this case are that the petitioner was initially appointed as Bull Attender in Animal Husbandry & Dairying Department. He was promoted to the post of Assistant Veterinary Field Officer (AVFO) on 7/8/2019 and was posted in the office of respondent no.5- Deputy Director, Animal Husbandry Services Department, Gwalior. During the year 2015-16, a complaint was received against the petitioner alleging that he has fraudulently obtained the reimbursement of medical expenses based upon forged and fabricated document. It appears that a preliminary enquiry was conducted by respondent no.5, wherein, the allegations made were prima facie found correct. Initially, a show cause notice was issued to the petitioner on 18/1/2016 (Annexure P/3), asking him to explain the aforesaid allegations. The petitioner gave his reply on 22/3/2016. It appears that no further action was taken pursuant to this show cause notice.

3. It appears that some communication was made by respondent no.2 with the State Govt. in response to which vide memo dated 13/12/2018 (Annexure P/5), the Additional Secretary, Veterinary Department wrote to respondent no.2 stating that the allegations made against the petitioner needs to be inquired into at his level only. The respondent no.2, thereafter, issued a charge-sheet to the petitioner vide memo dated 27/3/2019 (Annexure P/6). Allegations made in this charge-sheet are with regard to obtaining reimbursement of the medical expenses, amounting to Rs.9,64,257/- in relation to the treatment of his wife and himself during the period ranging from 2010-11 to 2014-15. The petitioner gave reply to this charge-sheet also on 27/3/2019 (Annexure P/6) and again nothing happened and the silence prevailed.

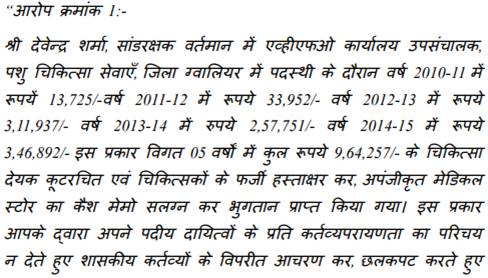

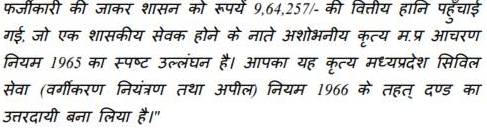

4. The respondent no.2 has now issued the impugned charge sheet dated 12/12/2024, (Annexure P/1) wherein, following charge has been levelled against the petitioner:-

5. The petitioner has challenged this charge-sheet as also the earlier charge-sheet dated 27/3/2019 primarily on the ground of delay. It is his submission that the show cause notice itself was issued after the delay of about 10 years while, the impugned charge-sheets have been issued after further lapse of about five years. He has also submitted that the issuance of charge-sheet dated 12/12/2024 & 27/3/2019, amounts to double jeopardy under Article 20(2) of the Constitution of India in view of show cause notice dated 18/1/2016 already issued to the petitioner in relation to same allegations. The petitioner has also alleges that respondent no.3, impleaded in persons capacity is biased against him, as a result of which, the impugned charge-sheets have been issued.

6. Challenging the impugned charge-sheets, learned counsel for the petitioner vehemently argued that the charge-sheets are liable to be quashed on the ground of inordinate unexplained delay. It is his submission that the allegations made against the petitioner in impugned charge-sheets relate back to year 2010-11 to 2014-15. Thus, the issuance of charge-sheet on 27/3/2019 and 12/12/2024 without there being any explanation for delay, vitiates the action taken by the respondents. In support of his submissions, he placed reliance upon the coordinate Bench decisions of this Court in the case of Mohinder Singh Kanwar Vs. State of M.P. & Ors. in W.P. No.12170/2021, Suraj Singh Shikarwar Vs. State of M.P. & Ors. in W.P. No.16471/2017 and Dinesh Awasthi Vs. State of M.P. & Ors. in W.P. No.4145/2015.

7. The learned counsel also argued that in view of show cause notice issued to the petitioner on 18/1/2016 under Rule 16 of M.P. Civil Services (Classification, Control & Appeal) Rules, 1966, issuance of subsequent charge-sheets vide memo dated 27/3/2019 and 12/12/2024 for the same set of allegations, amount to double jeopardy. It is his submission that the petitioner gave reply to the show cause notice on 22/3/2016 and thereafter, no action was taken for substantial period of more than three years, which goes to show that respondents were satisfied with the reply given by the petitioner. The learned counsel for the petitioner argued that the respondent no.3 is biased against the petitioner and therefore, with malafide intention, the impugned action is being taken against him. He thus, prayed for quashing of the impugned charge-sheet.

8. On the other hand, counsel for the State supported the impugned action of respondents and submitted that the charge-sheets are based upon the allegations ranging from year 2010-11 to 2014-15.It is his submission that there is no inaction on the part of respondents and show cause notice/charge-sheets were issued to petitioner from time to time. It is his submission that the charge-sheets cannot be quashed merely based upon the delay in issuance of same particularly when the allegations made against the delinquent are serious in nature. He further denied that the impugned charge-sheets have been issued by respondent no.3 without any malafide intention. The learned counsel for the State also submitted that the allegations of fraudulent withdrawal of Govt. money in the shape of medical expenses have been prima facie found correct and therefore, matter needs to be inquired into. He thus, prayed for dismissal of the writ petition.

9. Considered the arguments and perused the record.

10. Before adverting to the facts of the case, the law with regard to quashing of charge-sheet on the ground of delay needs to be examined. The Apex Court in the case of Addl. Supdt. of Police v. T. Natarajan reported in 1999 SCC (L&S) 646 held in para 7 as under:-

7. In regard to the allegation that the initiation of the disciplinary proceedings was belated, we may state that it is settled law that mere delay in initiating proceedings would not vitiate the enquiry unless the delay results in prejudice to the delinquent officer. In this case, such a stage as to examine that aspect has not arisen.

11. Again in the case of LIC v. A. Masilamani, reported in (2013)6 SCC 530, Apex Court has considered the similar issue in detail and held in para 18 as under:-

18. The court/tribunal should not generally set aside the departmental enquiry, and quash the charges on the ground of delay in initiation of disciplinary proceedings, as such a power is dehors the limits of judicial review. In the event that the court/tribunal exercises such power, it exceeds its power of judicial review at the very threshold. Therefore, a charge-sheet or show-cause notice, issued in the course of disciplinary proceedings, cannot ordinarily be quashed by the court. The same principle is applicable in relation to there being a delay in conclusion of disciplinary proceedings. The facts and circumstances of the case in question have to be examined taking into consideration the gravity/magnitude of charges involved therein. The essence of the matter is that the court must take into consideration all relevant facts and to balance and weigh the same, so as to determine if it is in fact in the interest of clean and honest administration, that the judicial proceedings are allowed to be terminated only on the ground of delay in their conclusion. (Vide State of U.P. v. Brahm Datt Sharma [(1987) 2 SCC 179 : (1987) 3 ATC 319 : AIR 1987 SC 943] , State of M.P. v. Bani Singh [1990 Supp SCC 738 : 1991 SCC (L&S) 638 : (1991) 16 ATC 514 : AIR 1990 SC 1308] , Union of India v. Ashok Kacker [1995 Supp (1) SCC 180 : 1995 SCC (L&S) 374 : (1995) 29 ATC 145] , Prohibition & Excise Deptt. v. L. Srinivasan [(1996) 3 SCC 157 : 1996 SCC (L&S) 686 : (1996) 33 ATC 745] , State of A.P. v. N. Radhakishan [(1998) 4 SCC 154 : 1998 SCC (L&S) 1044 : AIR 1998 SC 1833] , M.V. Bijlani v. Union of India [(2006) 5 SCC 88 : 2006 SCC (L&S) 919 : AIR 2006 SC 3475] , Union of India v. Kunisetty Satyanarayana [(2006) 12 SCC 28 : (2007) 2 SCC (L&S) 304] and Ministry of Defence v. Prabhash Chandra Mirdha [(2012) 11 SCC 565 : (2013) 1 SCC (L&S) 121 : AIR 2012 SC 2250] .)

12. Thus, a cumulative assessment of legal proposition in the aforesaid cases goes to show that a charge-sheet cannot be quashed solely on the ground of delay and the Court is required to take into account all relevant facts including the gravity of charges levelled against the delinquent. The Court is required to balance and weigh the circumstances to determine, if it is in the interest of clean and honest administration that the proceedings are allowed to be terminated on the ground of delay. Further the proceedings can be quashed on the ground of delay only when the delinquent can establish in enquiry, the prejudice caused to him because of lapse of time.

13. Recently, the similar issue again came up for consideration before the Apex Court in the case of S. Janaki Iyer v. Union of India reported in (2025)8 SCC 696. In this case, The Apex Court while considering the issuance of charge-sheet after the delay of nine years, has held as under:-

28. Mere delay during the inquiry proceedings, when it is explained with regard to the time taken for the inquiry to conclude and that too justifying the same with no prejudice having been caused, cannot be made the basis for vitiating the departmental proceedings. Inordinate or unexplained delay in the departmental proceedings may be a justifiable ground if tampered with prejudice having been established to have been caused to the delinquent employee in the said process for interference by the Court. In the present case, the same is absent and therefore the said plea of delay fails.

14. Keeping into account the aforesaid legal position, the allegations made against the petitioner, needs to be examined. The statement of imputations annexed alongwith the charge-sheet goes to show that the petitioner has been charged with the allegation of withdrawal of Govt. money towards medical reimbursement of himself and of his wife on the basis of forged & fabricated medical bills. In this regard, the respondent no.5 verified the documents from Dr. Puneet Rastogi, HOD, Cardiology Department, GR Medical College, Gwalior who has certified that the documents do not bear his signatures.

15. It is further alleged against the petitioner that he took reimbursement towards purchase of medicines from the medical stores which are not found registered. This has been certified by the Drug Inspector. Further the post facto sanction for reimbursement of medical expenses incurred in his wife's treatment at CHL Apollo Hospital, Indore amounting to Rs.1,37,418/- during 13/9/2012 to 8/2/2013 has been found to be not issued from the Office of Divisional Joint Director, Health Services, Gwalior.

16. It is thus seen that allegations made against the petitioner are serious enough and are based upon the documentary evidence. Allegations are yet to be established in the enquiry. As per the allegations made, there is total defalcation of Rs.9,64,257/-.

17. It is a common knowledge that in the Govt. departments, the proceedings are delayed because of various reasons. Most of the time, it is because of the lethargic attitude and inaction on the part of responsible officers. Many a times, it is because of the influence that may have been exercised by the delinquent. Nobody personally loses anything because of such delay. However, ultimately it is the public money and/or public interest which is to be taken into account. There may be cases where the allegations levelled against the delinquent are petty and not that serious which may warrant probe after lapse of substantial period of time. However, there are cases, like the present one, where not only the public money is at stake but also the integrity and honesty of the delinquent is to be enquired into. All these aspects are to be looked into while considering the challenge to the charge sheet on the ground of delay. In the facts and circumstances of this case, it would not be in the interest of clean and honest administration that the charge-sheet is quashed at this stage merely on the ground of delay. Needless to mention, the petitioner is at liberty to establish prejudice that may have been caused to him because of delay in initiation of enquiry, during the course of departmental enquiry.

18. The petitioner's counsel next argued that a show cause notice under Rule 16(1)(a) of CCA Rules was issued to the petitioner on 18/1/2016. In this regard it is seen that the caption of this show cause notice though suggest that it is issued under Rule 16(1)(a), however, the concluding paragraph only asks the petitioner to give reply to the show cause notice, failing which, the proceedings for placing him under suspension and initiating disciplinary proceedings shall be initiated under Rule 9 of the CCA Rules. The relevant extract of the show cause notice is reproduced hereunder:-

19. Thus, it is seen that the disciplinary proceedings were not actually initiated by this show cause notice but were only proposed to be initiated. Thus, it cannot be said that minor penalty proceedings were initiated against the petitioner.

20. The charge sheet dated 27/3/2019 levels the same charge which has been levelled in the subsequent charge-sheet dated 12/12/2024. The petitioner is, therefore, right in contending that the allegations levelled in both the charge-sheets are same. The respondents have not given any explanation for issuance of two charge-sheets for the same allegation. However, the larger issue for consideration is as to whether, the subsequent charge-sheet dated 12/12/2024 would be vitiated on this ground or not?

21. After issuance of charge-sheet dated 27/3/2019, petitioner submitted reply to the same on 23/4/2019 and admittedly, nothing happened thereafter. In other words, the enquiry pursuant to charge-sheet dated 27/3/2019 did not commence and the same has not yet culminated into a final order. The second charge sheet is then issued to him for the same charge on 12/12/2024. Since, enquiry has yet not commenced, there would be no impediment in conducting enquiry either pursuant to earlier charge sheet dated 27/03/2019 or subsequent charge-sheet dated 12/12/2024. The issuance of subsequent charge sheet dated 12/12/2024 only shows that the charge-sheet dated 27/3/2019 is dropped by the respondents and the same is not to be proceeded further. The respondents are, therefore, entitled to continue with enquiry pursuant to charge sheet dated 12/12/2024 only.

22. The petitioner's counsel has also raised the ground with regard to double jeopardy as enshrined under Article 20(2) of the Constitution of India. This argument is based upon issuance of show cause notice dated 18/1/2016 and charge-sheet dated 27/3/2019 before issuing charge sheet dated 12/12/2024. On the face of it, this argument has also no legs to stand. Article 20(2) of the Constitution of India provides that no person shall be prosecuted and punished for the same offence more than once. Thus, what is prohibited under Article 20(2) is prosecution/punishment for the same act. Admittedly, pursuant to show cause notice dated 18/1/2016 and/or charge-sheet dated 27/3/2019, no punishment has yet been imposed upon the petitioner. In fact, no enquiry is commenced pursuant to the aforesaid show cause notice/charge-sheet. Thus, the argument alleging double jeopardy invoking Article 20(2) of the Constitution of India is not available to the petitioner.

23. The learned counsel for the petitioner next contended that respondent no.3, who is working as Director of the Department i.e. respondent no.2, is biased against him. However, except this bald averment in para 5.14 of the petition, no allegation has been made as to why, respondents no. 3 would be biased against him. Thus, in absence of specific allegations, the bald assertion of mala fide is not acceptable.

24. The learned counsel for the petitioner has placed reliance upon the decision rendered by Coordinate Benches of this Court in the cases of Mohinder Singh Kanwar, Suraj Singh Shikarwar & Dinesh Awasthi (supra). In all these cases, this Court has quashed the charge-sheet on the ground of delay. However, a meticulous examination of facts of these cases show that the jurisdiction was exercises by this Court based on facts of the case and no hard and fast rule is laid to say that in all cases where there is delay, the charge-sheet is liable to be quashed. In fact in all these cases, the Apex Court decisions rendered in the cases of State of M.P. Vs. Bani Singh, reported in 1990 Supp. SCC 738, State of A.P. Vs. N. Radhakishan, reported in (1998)4 SCC 154 and M.V. Bijlani Vs. Union of India, reported in (2006)5 SCC 88, etc. have been taken into account. In all these cases, the Apex Court has not laid down as a thumb rule that the charge-sheet is liable to be quashed on the ground of delay in every case. On the contrary, the Apex Court has observed that the decision is required to be taken based upon the facts of individual case. Pertinently, the aforesaid Apex Court decisions were considered by the Apex Court in subsequent decision of A. Masilamani (supra).

25. Thus, the petitioner does not get any assistance from the aforesaid judgments rendered by the Coordinate Benches of this Court.

26. In view of the aforesaid, challenge to the impugned charge-sheet in the present petition fails, the petition is accordingly dismissed. However, it is directed that the respondents are at liberty to proceed further with the charge sheet dated 12/12/2024. It is expected that the respondents shall conclude the proceedings expeditiously without any further delay. The interim order passed earlier stands vacated.