Digital KYC Made Easier for Persons with Disabilities: Supreme Court and RBI Issue Inclusive Guidelines

UDID number and accessible portals ensure smoother verification for differently abled customers

Banks and financial institutions must provide alternative KYC methods for visually impaired and physically challenged persons

By Our Legal Reporter

New Delhi: December 01, 2025:

In a landmark move, India has made Know Your Customer (KYC) processes more inclusive for persons with disabilities. Following a Supreme Court directive in April 2025, the Reserve Bank of India (RBI) and the Central KYC Records Registry (CKYCRR) have issued guidelines to ensure that people with visual impairments, physical disabilities, or facial disfigurements can complete KYC without facing discrimination or unnecessary hurdles.

Also Read: Indian Law Firms Merge for Scale Amid Rising Client Demands and Global Competition

This reform is expected to benefit millions of differently abled citizens who previously struggled with traditional KYC methods that relied heavily on facial recognition or physical presence.

Why KYC Was Difficult for Persons with Disabilities

Traditional KYC processes often required:

- Physical presence at bank branches

- Facial recognition or biometric verification

- Manual paperwork

For persons with disabilities, especially those with visual impairments or facial disfigurements, these requirements created barriers. Many were denied services or faced repeated delays in opening accounts, accessing loans, or investing in securities.

Supreme Court’s Intervention

In Pragya Prasun & Ors. vs Union of India and Amar Jain vs Union of India & Ors., the Supreme Court directed regulators to make digital KYC accessible. The Court emphasized that financial inclusion must extend to persons with disabilities and ordered banks, NBFCs, and payment providers to adopt alternative verification methods.

RBI and CKYCRR Guidelines

Following the Court’s order, the RBI issued a circular in August 2025, mandating all regulated entities to comply. The CKYCRR also updated its KYC template to include:

- Differently abled status

- Type of impairment

- Percentage of impairment

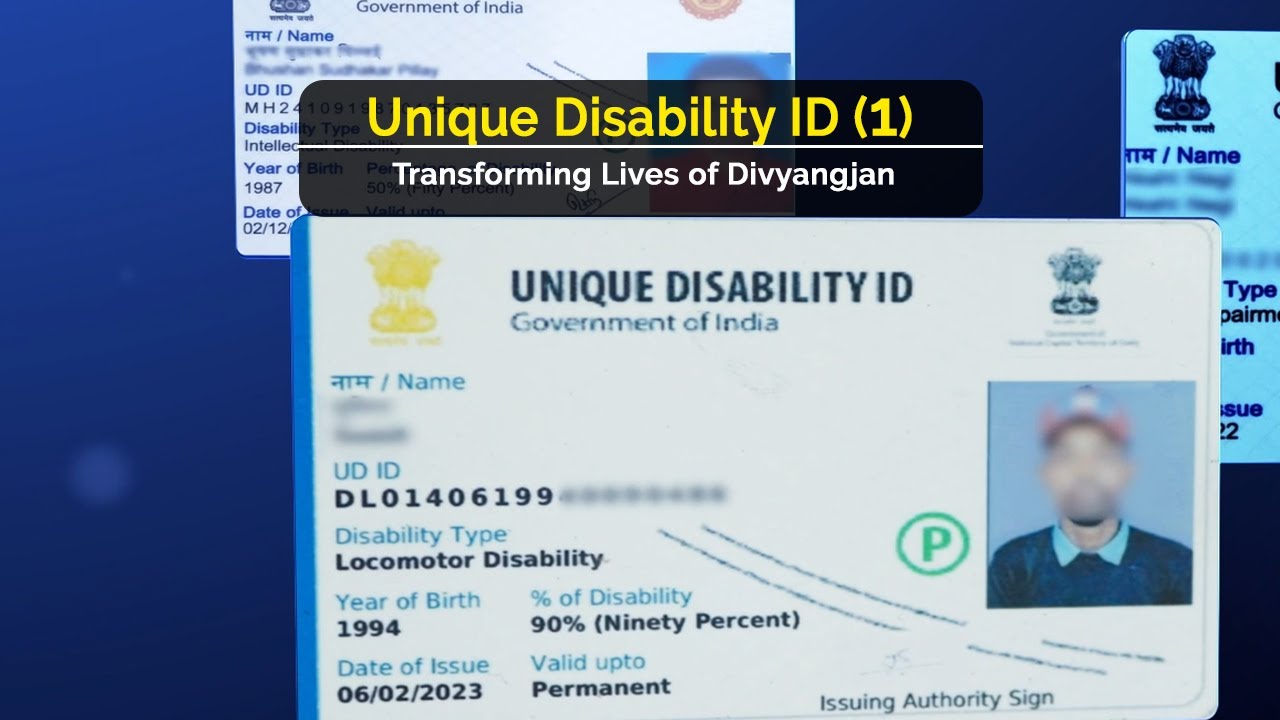

- Unique Disability ID (UDID) number

These fields ensure that disability details are formally recorded and recognized during KYC.

Steps Persons with Disabilities Should Take for Easy KYC

1. Obtain a Unique Disability ID (UDID)

- Apply for a UDID card through the government’s disability portal.

- This card serves as a universal proof of disability across India.

- Use the UDID number during KYC to simplify verification.

2. Update Disability Details in CKYCRR

- Ensure that your disability status, type, and UDID number are updated in the Central KYC Records Registry.

- This prevents repeated documentation across different banks or financial institutions.

3. Request Alternative Verification Methods

- RBI mandates banks to provide non-biometric options for those unable to use facial recognition or fingerprints.

- Persons with disabilities can request video KYC, OTP-based verification, or assisted digital KYC.

4. Use Accessible Digital Platforms

- Banks and NBFCs must now provide screen-reader friendly portals and voice-enabled apps.

- Persons with visual impairments should insist on these accessible options.

5. Seek Help from Ombudsman if Denied

- If a bank refuses to provide inclusive KYC, customers can approach the RBI Ombudsman.

- Complaints can also be filed with the Department of Empowerment of Persons with Disabilities (DEPwD).

Benefits of Inclusive KYC

Also Read: Supreme Court Rules No Review or Appeal Allowed Against Arbitrator Appointment Orders

- Financial inclusion: Ensures persons with disabilities can open accounts, invest, and access loans.

- Reduced discrimination: Prevents denial of services due to physical or visual impairments.

- Convenience: Digital KYC eliminates repeated visits to branches.

- Legal protection: Supreme Court’s order gives persons with disabilities a strong legal backing.

Industry Impact

Banks and financial institutions must now redesign their systems to comply with accessibility standards. This includes:

- Updating mobile apps and websites for screen readers.

- Training staff to handle alternative KYC requests.

- Integrating UDID numbers into customer databases.

Experts believe this reform will boost trust in India’s financial system and encourage more persons with disabilities to participate in banking and investment.

Voices from the Ground

- Visually impaired customers say the new rules give them dignity and independence.

- Disability rights activists welcome the move but stress the need for strict enforcement.

- Bank officials acknowledge that while implementation requires investment, it will expand customer reach.

Conclusion

The Supreme Court’s directive and RBI’s circular mark a turning point in India’s financial inclusion journey. By making KYC accessible to persons with disabilities, India is ensuring that no citizen is left behind in the digital economy.

For persons with disabilities, the path is now clearer: obtain a UDID, update CKYCRR records, request alternative verification, and insist on accessible platforms. With these steps, they can complete KYC easily and enjoy equal access to financial services.

🔑 Suggested Keywords for SEO & Faster Searches

- Digital KYC for persons with disabilities India

- RBI KYC guidelines disabled customers

- Supreme Court KYC accessibility ruling 2025

- UDID card KYC India

- CKYCRR disability fields update

- Alternative KYC methods RBI circular

- Accessible banking for visually impaired India

- Disability rights financial inclusion India

- Video KYC for disabled customers India

- RBI Ombudsman disability complaints