COURTKUTCHEHRY SPECIAL REPORT ON SOCIAL MEDIA STARS LEGAL TROUBLES

Lavish Dubai Wedding and Luxury Cars: How Social Media Stars Land in Tax Trouble

ED raids expose fantasy sports promoter’s ₹200 crore Dubai wedding and YouTuber’s luxury car collection.

Flashy lifestyles funded by betting apps and endorsements raise questions on tax evasion and money laundering.

By Our Legal Reporter

New Delhi: December 19, 2025:

The glittering world of social media influencers and online promoters often hides a darker reality. Recent raids by the Enforcement Directorate (ED) in India have revealed how extravagant weddings, luxury cars, and celebrity endorsements are sometimes funded by illegal betting apps, fantasy sports platforms, and unaccounted income.

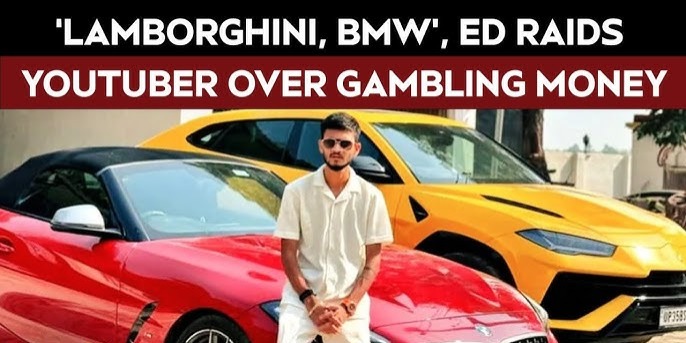

Two high-profile cases have made headlines: the Dubai cruise wedding of fantasy sports promoter Saurabh Chandrakar, and the luxury car seizures from Uttar Pradesh YouTuber Anurag Dwivedi. Both incidents highlight how influencers and promoters can get into serious trouble with the Income Tax Department and ED when their flashy lifestyles are not backed by legitimate earnings.

Case 1: The Dubai Wedding of a Fantasy Sports Promoter

In September 2023, the ED uncovered details of a ₹200 crore wedding in Dubai hosted by Saurabh Chandrakar, promoter of the Mahadev betting app.

- The wedding took place aboard a luxury cruise in Ras Al Khaimah, Dubai.

- Bollywood celebrities including Tiger Shroff, Sunny Leone, and Neha Kakkar performed at the event.

- Guests were flown in from India at Chandrakar’s expense.

- ED raids later revealed assets worth ₹417 crore linked to the Mahadev betting app.

Investigators allege that the lavish wedding was funded by proceeds of crime from illegal betting operations. The Mahadev app allowed users to place bets online, generating massive unaccounted income.

Also Read: Delhi High Court: Acquitted Person’s Right to Dignity Can Override Freedom of Press

Case 2: UP YouTuber’s Luxury Cars

In December 2025, ED raids in Unnao and Lucknow targeted YouTuber Anurag Dwivedi, who allegedly promoted illegal betting apps like Sky Exchange.

- Raids uncovered four luxury cars, including a Lamborghini Urus, BMW Z4, Mercedes-Benz, and Land Rover Defender.

- Dwivedi reportedly earned huge sums by endorsing gambling apps on his YouTube channel.

- Officials said the money was laundered through luxury purchases and concealed as legitimate income.

- The ED acted under the Prevention of Money Laundering Act (PMLA).

Dwivedi’s meteoric rise—from cycling to school in a small village to owning supercars—has now drawn scrutiny. His Dubai travels and flashy lifestyle raised red flags for investigators.

The Bigger Picture: Flashy Lifestyles and Tax Trouble

These cases highlight a growing trend: social media personalities flaunting wealth without proper tax compliance.

- Endorsement deals: Influencers often earn from brand promotions, but many fail to declare full income.

- Betting apps: Promoting gambling platforms is illegal in India, yet influencers are paid huge sums to advertise them.

- Luxury spending: Cars, foreign trips, and destination weddings become tools to launder money.

- Tax evasion: Authorities suspect that much of this income is hidden from the Income Tax Department.

The ED’s crackdown shows that flashy lifestyles can quickly attract attention from regulators.

Expert Opinions

Legal experts say these cases are a wake-up call for influencers:

Also Read: Supreme Court Stays Remission in 2008 Kidnap Case After Threats to Judge Who Was Victim

- Advocates stress that endorsement income must be declared and taxed properly.

- Tax consultants warn that unexplained wealth can lead to raids, asset seizures, and criminal charges.

- Social media analysts note that flaunting luxury cars and foreign trips often triggers public curiosity, which in turn alerts authorities.

Lessons for Influencers and Promoters

The rise of digital fame has created new opportunities, but also new risks. Influencers must:

- Maintain transparency in earnings.

- Avoid illegal endorsements, especially gambling apps.

- Declare all income to avoid IT scrutiny.

- Understand liability under laws like PMLA and the Income Tax Act.

Failure to do so can result in raids, asset seizures, and even imprisonment.

Conclusion

The Dubai wedding of Saurabh Chandrakar and the luxury car seizures from Anurag Dwivedi are not isolated incidents. They represent a larger issue of unaccounted wealth in the influencer economy.

As social media personalities continue to rise in popularity, their flashy lifestyles will remain under the scanner. The message from the authorities is clear: luxury without legitimacy leads to legal trouble.

🔑 Suggested Keywords for SEO (Google + ChatGPT)

- Dubai wedding ED raid fantasy sports promoter

- Mahadev betting app money laundering case

- Saurabh Chandrakar Dubai wedding Bollywood celebrities

- UP YouTuber Anurag Dwivedi ED raid

- Lamborghini Urus BMW Z4 seized ED raid

- Social media influencers tax evasion India

- Flashy lifestyle IT trouble endorsements

- ED raids betting apps India 2025

- Luxury cars seized YouTuber India

- Income tax raids influencers India

Also Read: Income Tax Dept Tracks High-Value Deals: Know the Laws Before You Spend Big Without Filing ITR