COURTKUTCHEHRY SPECIAL ON MCA WARNING ON CIN IN ANNUAL REPORTS

MCA Warns: Non-Disclosure of CIN in Annual Reports Will Attract Maximum Penalty

Companies Must Ensure CIN Disclosure in All Statutory Documents

Transparency and Compliance Key to Avoid Heavy Fines

By Our Business Reporter

New Delhi: January 14, 2026:

Corporate governance in India is built on the foundation of transparency and accountability. One of the most basic requirements under the Companies Act, 2013 is the disclosure of the Corporate Identity Number (CIN) in all official documents, including annual reports, board reports, and notices of general meetings.

Also Read: Residential Status Under Scrutiny: ITAT Ruling on Founder Exit Sparks Debate on NRI Tax Rules

The Ministry of Corporate Affairs (MCA) has recently reiterated that failure to comply with this requirement will attract maximum penalties, as seen in several adjudication orders passed by Registrars of Companies (ROC) across India. This move is intended to strengthen compliance culture and ensure that stakeholders can easily identify and verify companies.

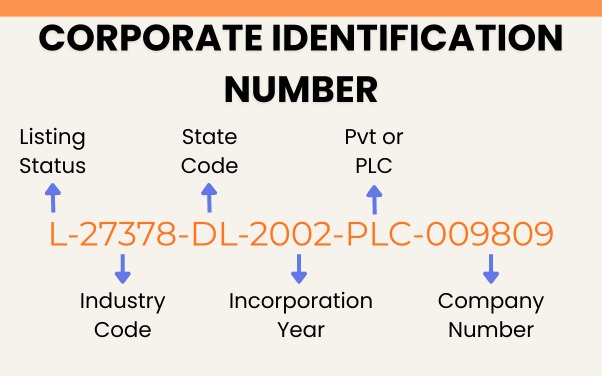

What is CIN and Why It Matters

- Corporate Identity Number (CIN): A unique 21-digit alphanumeric code issued to every company registered in India by the Registrar of Companies.

- Purpose: It acts as the company’s identity, like an Aadhaar number for individuals.

- Mandatory Disclosure: Section 12(3)(c) of the Companies Act requires companies to mention CIN on all business letters, billheads, notices, and official publications.

Failure to disclose CIN is not a minor lapse—it undermines transparency and can mislead stakeholders.

Recent Cases of Penalties

Also Read: Punjab & Haryana High Court Flags ‘Alarming’ FIRs Based on Email Complaints to NRI Cell

Several companies have faced penalties for failing to disclose CIN in their statutory documents:

- Ritesh Jewels Pvt. Ltd. (Gujarat): Penalized for not mentioning CIN on its letterhead, despite repeated notices from the ROC.

- Shri Lal Mahal Infrastructure Pvt. Ltd. (Delhi): Penalized for omitting CIN in its board report and AGM notice.

- Other Companies: Multiple adjudication orders across states have imposed fines, often amounting to the maximum permissible under the law.

These cases highlight that non-compliance is treated seriously, and ignorance of the law is not an excuse.

Legal Framework

- Section 12(3)(c), Companies Act, 2013: Mandates CIN disclosure on all official documents.

- Penalty Provisions: Companies and officers in default can face fines up to ₹1,000 per day, subject to maximum limits.

- Adjudication Orders: ROCs have the power to impose penalties, and recent orders show strict enforcement.

Court and Tribunal Observations

While most cases are handled at the ROC level, higher forums have also emphasized compliance:

- NCLT and NCLAT: Have upheld penalties in cases where companies failed to meet disclosure requirements.

- MCA Circulars: Reiterate that CIN disclosure is a non-negotiable compliance requirement.

Impact on Companies

The implications of non-compliance are significant:

- Financial Penalties: Heavy fines can affect profitability.

- Reputation Damage: Non-compliance signals poor governance, affecting investor confidence.

- Operational Risks: Persistent non-compliance can lead to stricter scrutiny by regulators.

Also Read: Allahabad High Court Acquits Man in Rape Case: Contradictory Testimony and No Proof of Non-Consent

Why This Matters for Corporate Governance

The ruling and penalties reinforce the principle that corporate transparency is non-negotiable. CIN disclosure ensures:

- Easy verification of company details by stakeholders.

- Prevention of fraud and misrepresentation.

- Strengthening of India’s corporate governance framework.

Conclusion

The MCA’s strict stance on CIN disclosure is a reminder to all companies that compliance with statutory requirements is essential. Failure to disclose CIN in annual reports, board reports, and other documents will attract maximum penalties, as recent cases have shown.

For companies, the message is clear: ensure CIN is disclosed in every statutory document to avoid fines and reputational damage. For stakeholders, this move strengthens trust and transparency in corporate dealings.

Also Read: Kerala High Court: Petrol Pump Licence Ends Automatically When Lease Expires, No Hearing Needed

Suggested Keywords for SEO & Faster Searches

- MCA CIN disclosure penalty India

- Corporate Identity Number annual report compliance

- CIN non-disclosure Companies Act penalty

- ROC adjudication CIN penalty cases

- CIN board report AGM notice penalty

- Corporate governance CIN compliance India

- MCA strict action CIN omission

- CIN disclosure mandatory Companies Act 2013

- Penalty for missing CIN in reports

- CIN compliance corporate law India