COURTKUTCHEHRY SPECIAL ON INDIA’s LARGEST CYBER FRAUD OPERATIONS

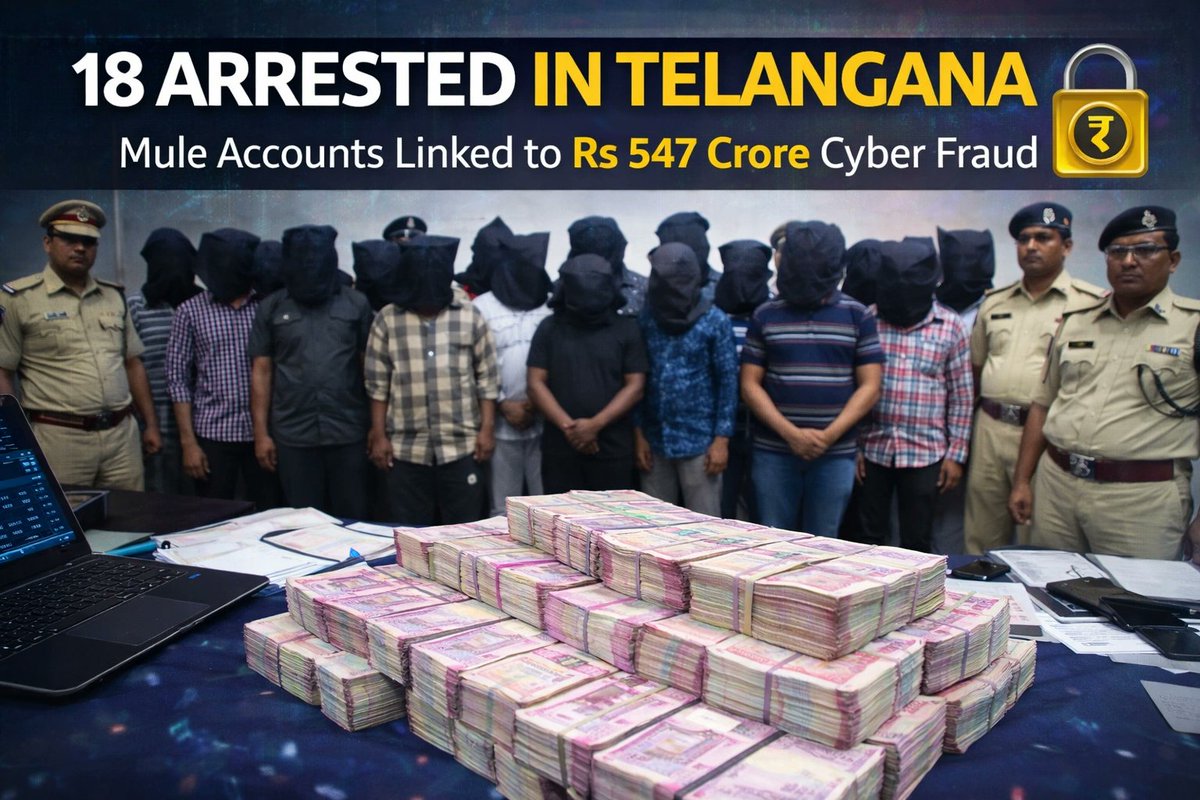

Telangana ₹547-Crore Cyber Fraud: How Crypto Was Used to Launder Money Abroad

Police Bust Mule Account Network Sending Funds to Cambodia

Case Sparks Debate on Crypto Safety and India’s Regulatory Framework

By Our Legal Reporter

New Delhi: January 13, 2026:

In January 2026, Telangana police uncovered one of India’s largest cyber fraud operations, involving ₹547 crore laundered through mule bank accounts and cryptocurrency transfers to Cambodia. The racket exposed how gangs lure unsuspecting individuals into opening accounts, use them to siphon money from cybercrime victims, and then convert the funds into crypto for cross-border transfers. The case has raised urgent questions about investor safety in crypto markets and the adequacy of India’s legal framework for digital assets.

Also Read: Himachal Pradesh High Court Upholds Five-Year Term Rule for Panchayati Raj Elections

The Gang’s Modus Operandi

Investigations revealed a sophisticated operation:

- Job Scam Recruitment: Fraudsters lured youngsters with fake job offers, convincing them to open bank accounts.

- Mule Accounts: These accounts were handed over to the gang, who used them to route money from cyber fraud victims.

- Layering Transactions: Funds were moved across multiple accounts to obscure the trail.

- Crypto Conversion: Large sums were converted into cryptocurrency, making tracking harder.

- International Transfers: Crypto was sent to Cambodia, where syndicates operated call centers targeting Indian victims.

- Collusion: Some insiders allegedly facilitated account restoration and shielded mule accounts from scrutiny.

Police arrested 18 mule account holders, while four prime accused remain at large. The case underscores how cybercrime networks exploit both banking loopholes and crypto anonymity.

Why GST and Cyber Frauds Are Rising

Cyber fraud and tax evasion rackets share common drivers:

- Digital Loopholes: Rapid digitization without adequate safeguards.

- Weak Enforcement: Limited manpower to monitor millions of accounts and transactions.

- High Profits: Fraudsters earn huge sums with low risk of detection.

- Cross-Border Networks: Crypto enables easy international transfers beyond traditional banking oversight.

Also Read: Supreme Court Quashes Attempt-to-Murder Case to Save Marriage, Accepts Husband’s Undertaking

What Investors Should Look for When Investing in Crypto

Crypto investors must adopt strict caution:

- Check Exchange Legitimacy: Use only government-compliant, registered exchanges.

- KYC Compliance: Ensure platforms follow Know Your Customer norms.

- Avoid Unrealistic Returns: Fraudsters often promise guaranteed profits.

- Secure Wallets: Use hardware wallets or trusted custodial services.

- Monitor Transactions: Track suspicious activity and report immediately.

- Stay Updated: Follow RBI and SEBI advisories on crypto risks.

Indian Laws on Crypto

India’s crypto regulation remains evolving:

- No Legal Tender: Crypto is not recognized as legal currency.

- Taxation: Since 2022, 30% tax on crypto gains and 1% TDS on transactions apply.

- Regulatory Oversight: SEBI and RBI monitor exchanges; compliance with anti-money laundering laws is mandatory.

- Pending Legislation: The government is considering a Digital Currency Bill to regulate private cryptocurrencies.

- CBDC Launch: RBI has introduced the Digital Rupee (CBDC) as a regulated alternative.

Also Read: Supreme Court Clarifies Equal Pay Rule: Contractual Workers Not Equal to Regular Staff

This framework aims to curb misuse while allowing innovation in blockchain technology.

Implications of the Case

- For Law Enforcement: Highlights need for stronger cybercrime units and international cooperation.

- For Investors: Reinforces importance of due diligence in crypto investments.

- For Policymakers: Urges faster implementation of comprehensive crypto laws.

- For Society: Raises awareness about risks of digital scams and importance of financial literacy.

Conclusion

The Telangana ₹547-crore cyber fraud case is a wake-up call for India. It shows how gangs exploit mule accounts and crypto to launder money abroad, while highlighting the urgent need for investor caution and stronger regulation. As India balances innovation with security, the case underscores that crypto is not inherently unsafe, but requires strict oversight and responsible use.

Also Read: Supreme Court Clarifies Equal Pay Rule: Contractual Workers Not Equal to Regular Staff

Suggested Keywords (SEO + ChatGPT Optimization)

- Telangana ₹547 crore cyber fraud

- Crypto fraud India Cambodia link

- Mule bank accounts cybercrime India

- Cryptocurrency scams India 2026

- Indian crypto laws RBI SEBI

- Digital Rupee CBDC India

- Crypto investor safety tips India

- Telangana police cyber fraud arrests

- International crypto laundering India

- Cybercrime and cryptocurrency regulation India

Also Read: Taj Hotels Secures India’s First Sound Mark in Hospitality and Digital Services