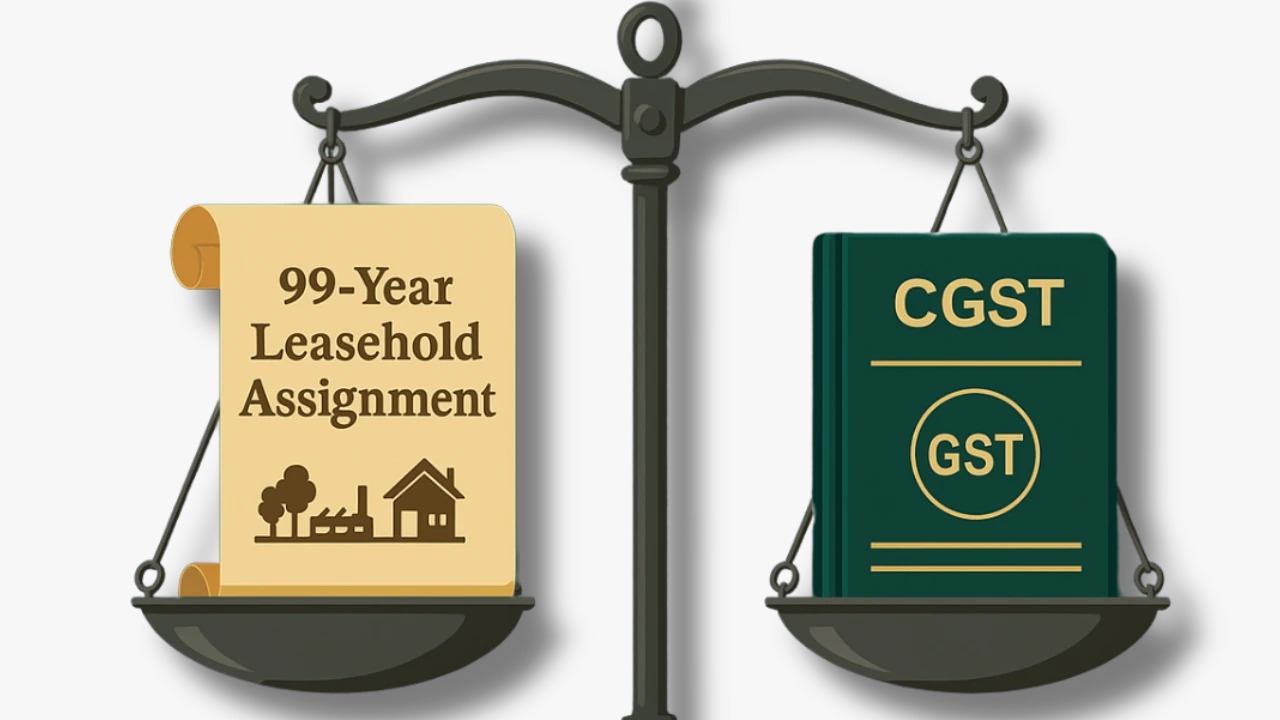

Bombay High Court: No GST on Transfer of Leasehold Rights by State Industrial Development Corporations

Bombay High Court rules that transfer of leasehold rights by State Industrial Development Corporations is not a supply of services and does not attract GST.