High Court Clarifies GST Law: Personal Hearing Details Must Be Clearly Communicated Before Adverse Orders

Court stresses importance of natural justice in GST adjudication

Ruling in Om Timber GSTIN v. State of U.P. strengthens taxpayer rights

By Our Legal Reporter

New Delhi: December 29, 2025:

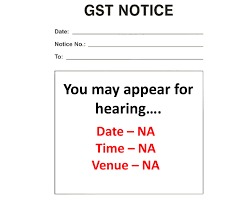

In a landmark judgment delivered in November 2025, the Allahabad High Court quashed an adverse GST order after finding that the taxpayer was not properly informed about the details of the personal hearing. The Court held that tax authorities must specifically communicate the date, time, and venue of personal hearings before passing any adverse order.

Also Read: Supreme Court Clarifies Tax Treatment of Non-Compete Fees: Revenue Expenditure, Not Capital

The case, Om Timber GSTIN v. State of Uttar Pradesh, reinforces the principle that fair hearing is a fundamental right under tax law and that procedural lapses cannot be ignored.

Background of the Case

- Petitioner: Om Timber GSTIN, a registered taxpayer under GST.

- Issue: The assessing authority issued a show-cause notice under Section 74 of the GST Act for FY 2021-22.

- Hearing lapse: The authority fixed a hearing date but did not communicate subsequent changes, eventually passing an ex-parte order.

- Petitioner’s contention: The taxpayer argued that the order was illegal as no proper hearing details were communicated.

- Court’s ruling: The Allahabad High Court agreed, quashing the order and directing fresh adjudication.

Court’s Observations

The Court made several important observations:

- Section 75(4) and (5): Mandates that taxpayers must be given a reasonable opportunity of being heard before adverse orders.

- Communication of details: Merely uploading a show-cause notice on the GST portal is insufficient; specific hearing details must be conveyed.

- Violation of natural justice: Passing orders without proper hearing violates constitutional principles of fairness.

- Fresh proceedings: The Court directed authorities to conduct fresh adjudication after properly informing the taxpayer.

Legal Context

- CGST Act, 2017: Section 75(4) requires that taxpayers be given a chance to be heard. Section 75(5) allows adjournments but mandates communication of hearing details.

- Principles of natural justice: No person should be condemned unheard.

- Judicial precedent: Courts have consistently quashed orders passed without proper hearing.

Also Read: Supreme Court Upholds Dismissal of CISF Constable for Second Marriage

Impact of the Ruling

The ruling has wide implications:

- For taxpayers: Strengthens protection against arbitrary ex-parte orders.

- For officers: Reinforces duty to ensure proper communication of hearing details.

- For judiciary: Provides clarity on procedural safeguards in GST adjudication.

- For governance: Encourages transparency and fairness in tax administration.

Expert Opinions

- Tax lawyers argue that the ruling prevents misuse of portal notices and protects taxpayer rights.

- Chartered accountants believe it will reduce litigation by ensuring fair hearings.

- Policy analysts note that the judgment strengthens trust in GST administration.

Comparison with Other Cases

|

Case Title |

Court |

Key Ruling |

|

Om Timber GSTIN v. State of U.P. |

Allahabad HC |

Hearing details must be communicated before adverse orders |

|

Exide Industries Ltd. v. AC, CGST |

Delhi HC |

Demand order quashed for lack of personal hearing |

|

S.P. Forms v. Deputy State Tax Officer |

Madras HC |

Officers must explore alternate service before ex-parte orders |

Broader Implications

The ruling also has implications for:

Also Read: Supreme Court Bars High Courts from Roving Enquiry in Cheque Bounce Cases

- Small businesses: Protects them from sudden ex-parte assessments.

- Digital governance: Highlights limits of relying solely on electronic service.

- Tax administration: Encourages officers to adopt a balanced approach.

- Public trust: Strengthens confidence in GST system by ensuring fairness.

Conclusion

The Allahabad High Court’s ruling in Om Timber GSTIN v. State of U.P. marks a critical clarification in GST law. By holding that personal hearing details must be specifically communicated before passing adverse orders, the Court has reinforced the principles of natural justice and fairness in taxation.

This judgment ensures that taxpayers are not penalized due to ineffective communication, strengthening trust in India’s GST administration.

GEO Keywords for Faster Searches

- Allahabad High Court GST personal hearing ruling

- Om Timber GSTIN v State of U.P. case

- GST personal hearing details India

- Section 75(4) GST Act hearing rights

- GST adverse order Allahabad HC ruling

- GST natural justice High Court India

- GST portal vs personal hearing communication

- GST taxpayer rights Allahabad HC judgment

- GST hearing details fairness India

- GST adjudication personal hearing ruling

Also Read: Delhi High Court Mandates Strict Three-Phase Safeguards for ED Property Seizures