CourtKutchehry Special Report

FAQ: How Private Trusts Help Families Optimise Tax and Succession in India

Tax Efficiency Through Income Splitting and Asset Structuring

Succession Planning and Global Compliance for NRIs and Family Businesses

By Our Legal Reporter

New Delhi: December 12, 2025:

Editorial Note

Private trusts are increasingly used by wealthy families in India to optimise taxation, manage succession, and protect assets. By carefully structuring trusts under the Income-tax Act, 1961, families can reduce tax burdens on dividends, interest, mutual fund income, and capital gains, while ensuring smooth intergenerational wealth transfer. Private trusts are not just tax shelters—they are governance tools. Families use them to optimise taxation of investment income, protect assets from risk, and ensure smooth succession. For NRIs, trusts provide cross-border compliance and treaty benefits. Testamentary trusts reduce litigation and probate delays. With India’s rising wealth and complex family structures, trusts are becoming indispensable instruments for both tax efficiency and stability.

Also Read: Supreme Court Restores Cheque Bounce Case Validity for Cash Loans Above ₹20,000

Q1. How can a Private Trust optimise taxation of dividend, interest, and mutual fund income?

A Private Trust holding investments such as shares, bonds, and mutual funds can distribute income among beneficiaries in a tax-efficient way. Dividends and interest income, normally taxed at slab rates, can be allocated to beneficiaries with lower incomes, reducing overall tax. Mutual fund gains continue to enjoy concessional rates under Section 112A (equity) and Section 112 (debt funds). By spreading income across multiple beneficiaries, trusts prevent any single person from entering the highest tax bracket. Families often create separate trusts for high-risk and low-risk portfolios, protecting gains and limiting exposure.

Q2. How can a Private Trust manage business assets and avoid Section 161(1A)?

Section 161(1A) imposes Maximum Marginal Rate (MMR) on business income of private trusts, except in narrow cases. To avoid this:

- Hold business assets through a company or LLP, with the trust owning shares rather than directly running the business.

- This way, the trust earns dividends or capital gains, taxed under normal provisions.

- Alternatively, a trust created through a Will for dependent relatives qualifies for statutory exception under Section 161(1A).

Proper structuring ensures trusts do not inadvertently attract punitive tax rates.

Q3. How can Private Trusts help in succession planning of family-owned businesses?

Private trusts allow intergenerational transfer of control without immediate tax events or probate disputes. Shares of a company can be transferred into an irrevocable trust without capital gains tax, since transfers under a Will are not considered “transfers” under Section 47(iii). The trust consolidates voting rights, prevents fragmentation of shareholding, and ensures continuity of management. Dividends are taxed in beneficiaries’ hands, often at favourable rates, while restructuring can occur at the trust level. This structure avoids family disputes and maintains business stability.

Also Read: Taxation of Public and Private Trusts in India: Key Rules, Exemptions, and Compliance Challenges

Q4. How can Private Trusts ensure tax efficiency for NRIs or foreign citizens?

When beneficiaries are NRIs or foreign citizens, trusts must comply with both Income-tax Act and FEMA rules. Income distributed to NRIs is taxable in India, but Double Tax Avoidance Agreements (DTAAs) can reduce liability. For example, certain capital gains may be taxed only in India or only abroad depending on treaty provisions. Trusts can accumulate income during adverse tax years and distribute later when beneficiaries are in favourable jurisdictions. Remittances must follow FEMA, but trust deeds can permit transfers abroad. This coordination ensures compliance and efficiency.

Q5. How does a testamentary Private Trust reduce disputes and tax inefficiencies?

A testamentary trust, created under a Will, comes into effect only after death. Benefits include:

- No gift tax, no capital gains on transfer, and no clubbing of income.

- Clear distribution instructions prevent family disputes.

- Courts uphold testamentary trusts as valid for orderly wealth transmission.

- Tax efficiency arises from income splitting, individual-based taxation, and deferral of tax events.

Such trusts also avoid probate delays, making them effective tools for succession and tax planning.

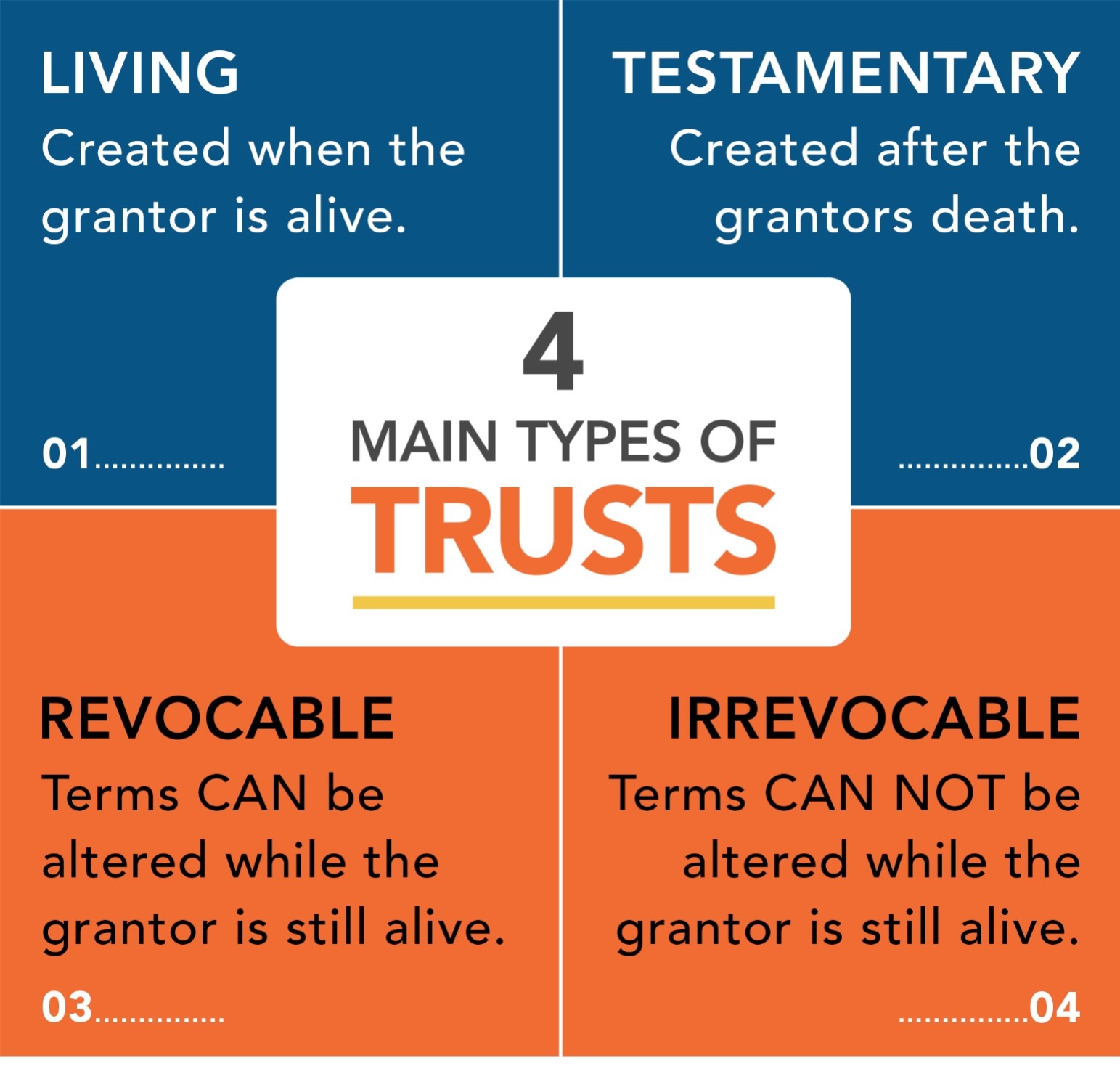

Visual infographic comparing public vs Private Trusts for taxation and planning.

📊 Public vs Private Trusts in India – Tax Rules & Benefits

|

Aspect |

Public Charitable/Religious Trusts |

Private Trusts (Specific & Discretionary) |

|

Exemption Basis |

Sections 11 & 12 – income applied to charitable/religious purposes |

No blanket exemption; taxed under Sections 161 & 164 |

|

Registration Requirement |

Mandatory under Section 12AB |

Not mandatory, but trust deed governs taxation |

|

Income Application |

Must apply 85% of income; up to 15% can be accumulated |

Trustee taxed as representative assessee |

|

Accumulation Beyond 15% |

Allowed under Section 11(2) with Form 10, specific purpose, max 5 years |

Not applicable |

|

Business Income |

Exempt if incidental to charitable objects & separate books maintained (Sec 11(4A)) |

Taxed at MMR under Sec 161(1A), except limited exceptions |

|

Anonymous Donations |

Taxable @30% under Sec 115BBC (except wholly religious trusts) |

Not applicable |

|

Corpus Donations |

Exempt under Sec 11(1)(d) with written direction & invested in Sec 11(5) modes |

Treated as trust income unless deed specifies otherwise |

|

Capital Gains |

Exempt under Sec 11(1A) if reinvested in new charitable assets |

Gains taxed in trustee’s hands; flow-through to beneficiaries |

|

Violation of Rules |

Section 13: misuse of funds → exemption withdrawn, taxed at MMR |

Revocable trusts taxed in settlor’s hands; discretionary trusts taxed at MMR |

|

Beneficiary Taxation |

Not applicable (public benefit) |

Specific trust: taxed at slab rates of beneficiaries; Discretionary trust: taxed at MMR |

|

Succession/Estate Planning |

Used for hospitals, schools, universities, social welfare |

Used for family wealth, succession, asset protection, cross-border estate planning |

Also Read: India’s IPO Boom Fuels Demand for Capital Markets Lawyers

Key Takeaways

- Public Trusts: Strong tax exemptions but strict compliance with Sections 11, 12, and 13. Violations lead to taxation at MMR.

- Private Trusts: Flexible for family tax planning and succession. Specific trusts allow income splitting, while discretionary trusts protect assets and manage global estate planning.

GEO Keywords for Faster Searches

- Private trust taxation India 2025

- Section 161(1A) business income trust

- Dividend and interest tax planning trusts

- Mutual fund capital gains trust Section 112A

- Succession planning family business trusts India

- Testamentary trust tax benefits India

- NRI beneficiaries private trust FEMA DTAA

- Revocable vs irrevocable private trust taxation

- Income splitting specific trust India

- Asset protection discretionary trust India

Also Read: ESOPs at Concessional Price: Experts Clarifies Taxability Under Income-tax Act