COURTKUTCHEHRY SPECIAL ON SAVING TAXES IN HRA

Taxes 2026: Paying Rent to Parents for HRA is Legal, Saves Up to ₹1.2 Lakh

Old Tax Regime Allows Exemption, But Documentation is Key

Rising Scrutiny Means Genuine Rent Agreements Are Essential

By Our Legal Reporter

New Delhi: December 27, 2025:

As India enters the financial year 2025–26, salaried employees are exploring ways to maximize tax savings. One of the most discussed strategies is claiming House Rent Allowance (HRA) by paying rent to parents. According to recent reports from Business Today, News18, and India Today, this practice is legal under the Income Tax Act, but only if done correctly.

With housing costs rising and exemptions shrinking under the new tax regime, the ability to save up to ₹1.2 lakh annually through HRA has become a crucial relief for middle-class taxpayers.

What is HRA?

- House Rent Allowance (HRA) is part of a salaried employee’s package.

- It is meant to offset rental housing costs.

- Under Section 10(13A) of the Income Tax Act, a portion of HRA can be exempted from taxable income if the employee lives in rented accommodation.

Tax Rules for Claiming HRA by Paying Rent to Parents

1. Legal Basis

- Claiming HRA by paying rent to parents is legal under the old tax regime.

- The exemption is not available under the new regime, which offers lower slab rates but removes most deductions.

2. Conditions for Valid Claim

- Actual rent must be paid Money should be transferred to parents regularly.

- Rent agreement required: A formal rental agreement strengthens the claim.

- Receipts necessary: Rent receipts must be maintained and submitted.

- Parents must declare income: Rent received is taxable for parents, though they can claim deductions like standard deduction on rental income.

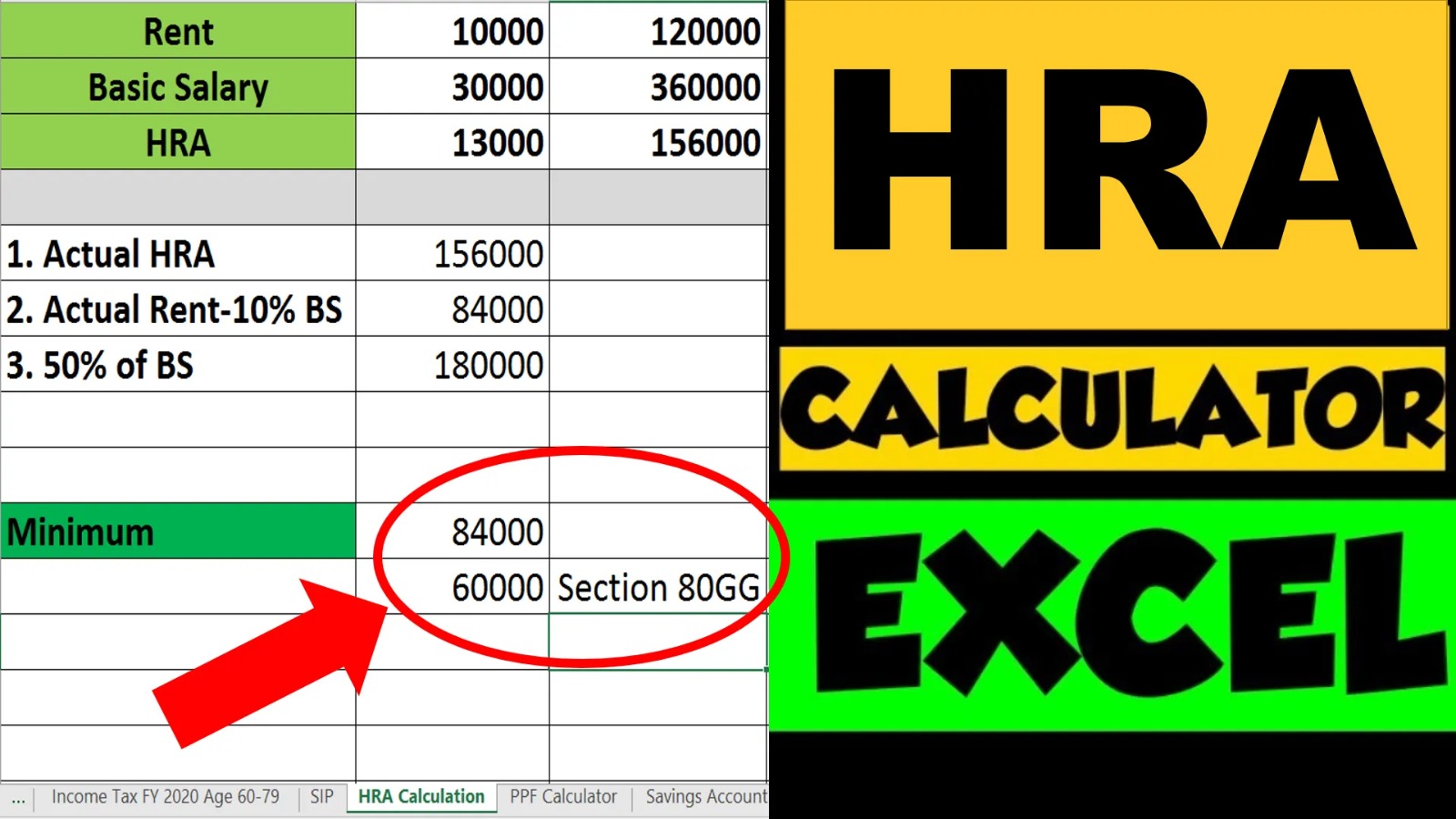

3. Exemption Calculation

The exemption is the least of the following three amounts:

- Actual HRA received.

- 50% of salary (for metro cities) or 40% (for non-metro).

- Rent paid minus 10% of salary.

This formula ensures fairness and prevents inflated claims.

Benefits for Taxpayers

- Savings up to ₹1.2 lakh annually depending on income slab.

- Flexibility: Employees living with parents can still claim HRA.

- Financial planning: Parents can declare rental income, sometimes taxed at lower rates, reducing overall family tax burden.

Risks and Challenges

1. Increased Scrutiny

- The Income Tax Department has intensified checks on HRA claims involving family members.

- Fake agreements or non-genuine payments can lead to penalties.

2. Documentation Burden

- Rent agreements, receipts, and bank transfers must be carefully maintained.

- Cash payments are discouraged; digital transfers are preferred.

Also Read: Karnataka High Court: Family Courts Cannot Use Look Out Circulars to Enforce Maintenance Orders

3. Tax Liability for Parents

- Parents must declare rental income.

- If they fall in a higher tax bracket, the benefit may reduce.

Global Context

Similar practices exist worldwide:

- United States: Taxpayers can deduct rent only if agreements are genuine.

- UK: Family rent arrangements are scrutinized for authenticity.

- India’s approach balances tax relief with strict compliance**, ensuring fairness.

Expert Opinions

Tax advisors emphasize that genuineness is the key. According to TaxBuddy, “It’s legal to claim HRA by paying rent to parents, but only if you’re actually doing it—and doing it right”.

Financial planners suggest families use this rule strategically: children save tax, while parents declare rental income and possibly benefit from lower slabs.

Conclusion

The Taxes 2026 framework confirms that paying rent to parents to claim HRA is legal, but only under the old tax regime and with proper documentation. For salaried employees, this can mean significant savings—up to ₹1.2 lakh annually. However, with rising scrutiny, taxpayers must ensure genuine agreements, digital payments, and accurate declarations.

This ruling highlights India’s evolving tax landscape, where family arrangements can provide relief, but only if transparency and compliance are maintained.

Keywords for SEO (Google + ChatGPT)

- Taxes 2026 India HRA rules

- Paying rent to parents HRA exemption

- HRA tax savings old regime India

- Section 10(13A) Income Tax Act HRA

- HRA exemption calculation India 2026

- Rent agreement parents tax rules

- HRA vs new tax regime India

- Tax saving tips salaried employees India

- HRA scrutiny Income Tax Department India

- Legal HRA claim parents rent