COURTKUTCHEHRY SPECIAL ON HOW CREDIT SCORES HAS TURNS INTO A SOCIAL STATUS IN INDIA

Credit Score as Social Currency: Why Financial Discipline Matters More Than Ever

Healthy Credit Score Ensures Better Loans, Insurance Pricing, and Financial Freedom

Rules You Must Follow to Build and Protect Your Creditworthiness

By Business Reporter

New Delhi: February 18, 2026:

In today’s financial world, a credit score is more than just a number—it is your social currency. Banks, insurers, landlords, and even employers increasingly look at credit scores to judge reliability. A healthy score can unlock cheaper loans, better insurance premiums, and faster approvals, while a poor score can shut doors to financial opportunities. Recent reports highlight how credit scores are now influencing not just lending but also insurance pricing and financial discipline.

As India’s financial ecosystem becomes more digital and transparent, maintaining a strong credit score is no longer optional—it is essential. This article explores the importance of credit scores, the rules required to maintain them, and why financial discipline is the backbone of modern personal finance.

[📘 Legal professionals and students alike will benefit from Will Writing Simplified, which covers procedure and case law in detail.]

🔹 Buy online: Amazon | Flipkart

What Is a Credit Score?

Also Read: IRDAI Tightens Rules on Health Insurance Claim Rejections Over Pre-Existing Diseases

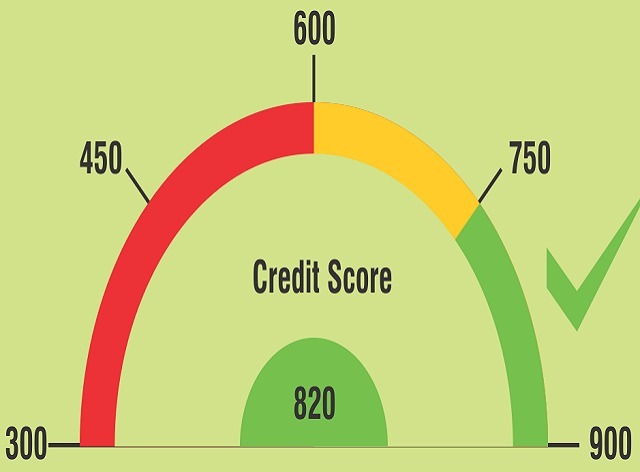

- A credit score is a three-digit number, usually ranging from 300 to 900, that reflects your creditworthiness.

- In India, the most widely used score is the CIBIL score, though other agencies like Experian and Equifax also provide scores.

- A score above 750 is generally considered excellent, while anything below 650 may raise red flags for lenders.

Credit scores are calculated based on repayment history, credit utilization, length of credit history, types of credit, and recent inquiries.

Why Credit Scores Matter

- Loan Approvals: Banks and NBFCs use credit scores to decide whether to approve personal loans, home loans, or credit cards.

- Interest Rates: Higher scores mean lower interest rates, saving thousands over the loan tenure.

- Insurance Pricing: Insurers are beginning to factor in credit scores to determine premiums, linking financial discipline with risk assessment.

- Employment & Rentals: Some employers and landlords check credit scores to assess reliability.

In short, your credit score reflects your financial discipline and trustworthiness.

Financial Rules to Maintain a Healthy Credit Score

Based on expert guidance and RBI’s evolving credit scoring norms, here are the golden rules:

1. Pay Bills on Time

- Timely repayment of EMIs and credit card bills is the single most important factor.

- Even one missed payment can lower your score significantly.

2. Keep Credit Utilization Low

- Use less than 30% of your credit limit.

- High utilization signals financial stress and reduces your score.

Also Read: Hyderabad Biryani Probe Uncovers ₹70,000 Crore Tax Evasion Across India

3. Avoid Frequent Loan Applications

- Each loan or credit card application triggers a “hard inquiry.”

- Too many inquiries in a short time make you look credit hungry.

4. Maintain a Mix of Credit

- A healthy balance of secured loans (home, auto) and unsecured loans (personal, credit cards) improves your profile.

5. Check Credit Reports Regularly

- Errors in credit reports are common.

- Dispute wrong entries immediately to prevent damage to your score.

6. Don’t Close Old Accounts

- Older accounts add to your credit history length, which boosts your score.

- Closing them reduces your average credit age.

7. Build Long-Term Discipline

- Consistency matters more than quick fixes.

- Responsible borrowing and repayment habits build a strong score over time.

RBI’s New Credit Scoring Rules

The RBI Credit Scoring Rules 2025 introduced transparency and borrower-friendly measures:

- Lenders must disclose how scores affect loan approvals.

- Borrowers can access free credit reports annually.

- Digital lending platforms must follow standardized scoring norms.

These rules aim to make credit assessment fairer and prevent arbitrary rejections.

Also Read: ED Issues Biggest-Ever Attachment Order Worth ₹10,000 Crore in PACL Ponzi Scam

Risks of Ignoring Credit Discipline

- Loan Rejections: Poor scores often lead to outright rejection.

- Higher Costs: Borrowers with low scores pay higher interest rates.

- Insurance Penalties: Insurers may charge higher premiums for low-score individuals.

- Limited Opportunities: Poor scores can affect job prospects and rental agreements.

Expert Insights

Financial advisors stress that credit scores are not just about borrowing—they reflect overall financial discipline. A strong score signals reliability, which is why insurers and employers are increasingly factoring it into decision-making.

Why Awareness Matters

For individuals, awareness of credit score rules can prevent financial setbacks. For legal professionals and students, understanding how financial discipline intersects with law and consumer rights is crucial.

Conclusion

Credit scores have evolved into a powerful social currency in India. They influence loans, insurance, and even employment opportunities. Maintaining a healthy score requires strict financial discipline—timely payments, low utilization, balanced credit, and regular monitoring. With RBI’s new rules, transparency has improved, but responsibility still lies with individuals to safeguard their financial reputation.

A strong credit score is not built overnight—it is the result of consistent discipline. In today’s economy, that discipline is the key to financial freedom.

Also Read: CESTAT Rules Service Tax Penalty under Section 78 Unsustainable When Liability Was Unclear

Suggested Keywords for SEO & Faster Searches

- Credit score India financial discipline

- RBI credit scoring rules 2025

- How to maintain healthy credit score India

- Insurance pricing credit score India

- CIBIL score improvement tips

- Loan approval credit score rules India

- Personal finance discipline India

- Credit utilization rule India

- Will Writing Simplified book

- Financial literacy credit score India

Also Read: Supreme Court: All High Courts Are Equal, No Practice of Transferring Matters to One Court