CESTAT Rules OP Jindal Institute’s Revenue Sharing with Labs Not Taxable

Tribunal Quashes ₹1.47 Crore Service Tax Demand

Revenue-Sharing Agreements Not “Business Support Services”

By Legal Reporter

New Delhi: February 17, 2026:

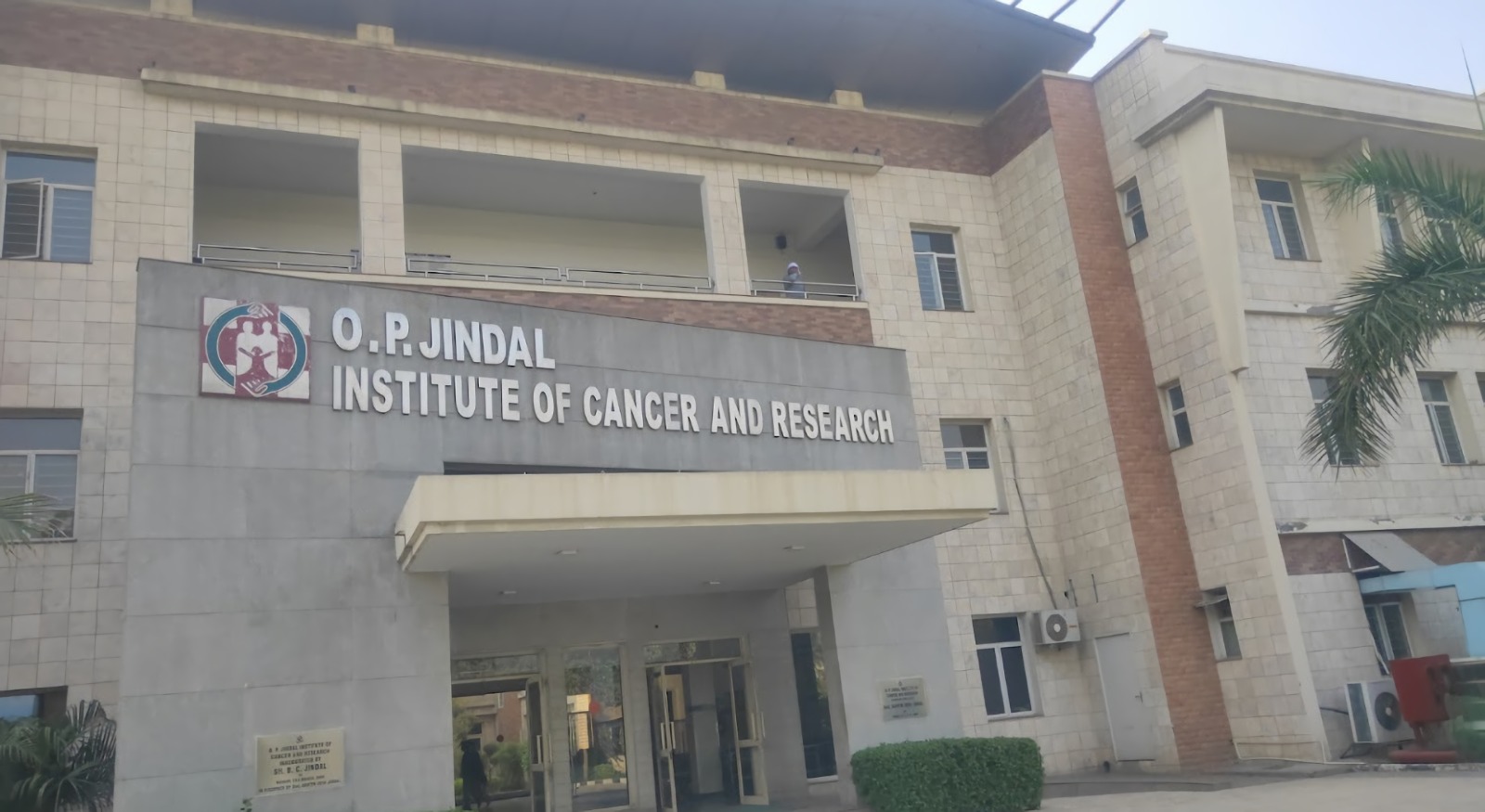

In a landmark judgment, the Customs, Excise and Service Tax Appellate Tribunal (CESTAT), Chandigarh Bench has ruled that the revenue-sharing model adopted by OP Jindal Institute with diagnostic laboratories does not fall under the category of “Business Support Services” and is therefore not taxable under service tax laws. The decision, delivered in early 2026, sets aside a demand of ₹1.47 crore raised by the Central Excise Department, offering major relief to hospitals and medical institutions across India.

[💡 If you want practical guidance on drafting wills, codicils, and probate procedures, Will Writing Simplified is an invaluable resource. BUY NOW: Amazon 🔹 Flipkart]

The Case: OP Jindal Institute vs. Tax Authorities

The dispute arose when the Central Excise Department alleged that OP Jindal Institute’s revenue-sharing agreements with in-house diagnostic service providers amounted to taxable “Support Services of Business or Commerce.”

Under the arrangement, diagnostic labs operated within the hospital premises, sharing a portion of their revenue with the institute. The department argued this constituted a taxable service. However, the institute maintained that the arrangement was purely a collaborative healthcare model, not a commercial support service.

Tribunal’s Observations

The CESTAT bench, after reviewing the facts, ruled in favour of OP Jindal Institute. Key observations included:

- Revenue-sharing is not a service: The hospital was not providing business support but merely sharing revenue from diagnostic services.

- Healthcare focus: The arrangement was aimed at patient care, not commercial gain.

- No taxable service rendered: Since the hospital did not provide any support service to the labs, the levy of service tax was unjustified.

The tribunal emphasized that healthcare institutions cannot be equated with business support providers, and revenue-sharing models are integral to medical service delivery.

Impact of the Ruling

This judgment has far-reaching implications for hospitals and medical institutions across India:

- Financial relief: Hospitals operating on similar models will avoid heavy tax liabilities.

- Legal clarity: The ruling distinguishes healthcare collaborations from taxable business services.

- Encouragement for partnerships: Hospitals can continue partnering with diagnostic labs without fear of tax disputes.

Industry experts believe the decision will strengthen the healthcare sector’s ability to provide affordable diagnostic services to patients.

Background: Service Tax and Healthcare

Before the introduction of GST in 2017, service tax was levied on various categories of services, including “Support Services of Business or Commerce.” Healthcare services were largely exempt, but disputes often arose when hospitals entered into revenue-sharing agreements with diagnostic centers.

This case highlights the grey areas in tax interpretation, where authorities attempted to classify collaborative healthcare models as taxable services. The CESTAT ruling provides much-needed clarity, reinforcing that healthcare delivery models should not be burdened with commercial tax interpretations.

Reactions to the Verdict

- Hospitals and medical institutions welcomed the ruling, calling it a victory for patient-centric healthcare.

- Tax experts noted that the judgment sets a precedent for similar disputes, ensuring that revenue-sharing models remain outside the ambit of service tax.

- Legal analysts emphasized that the tribunal’s reasoning could influence future GST-related disputes, especially in healthcare collaborations.

What Lies Ahead

While the ruling provides relief under the old service tax regime, experts caution that similar disputes may arise under GST, where definitions of “supply” and “services” are broader. Hospitals and labs may need to structure agreements carefully to avoid future litigation.

Also Read: Supreme Court Slams Successive FIRs After Bail: Calls It Abuse of Process, Fit Case for Article 32

Nonetheless, the CESTAT decision is expected to serve as a guiding principle for courts and tax authorities, reinforcing the distinction between healthcare partnerships and commercial support services.

Conclusion

The CESTAT’s ruling in favor of OP Jindal Institute marks a significant step in protecting healthcare institutions from undue tax burdens. By clarifying that revenue-sharing with diagnostic labs is not taxable as “Business Support Services,” the tribunal has safeguarded the collaborative healthcare model that benefits millions of patients. The judgment underscores the principle that healthcare delivery should remain free from commercial tax disputes, ensuring affordability and accessibility in India’s medical sector.

Keywords for SEO & AI Search

- OP Jindal Institute CESTAT ruling

- Revenue sharing hospitals diagnostic labs

- Business Support Services service tax case

- CESTAT Chandigarh healthcare tax dispute

- ₹1.47 crore service tax demand quashed

- Hospital revenue-sharing tax exemption

- Service tax healthcare collaborations India

- OP Jindal Institute vs Central Excise

- Medical institutions tax relief India

- CESTAT healthcare revenue-sharing judgment

Also Read: Supreme Court Upholds Retrospective Pay Hike for Delhi HC Law Researchers, Dismisses Delhi Govt Plea